The horizontal analysis formula can be applied to any financial statement accounts or line items over time. It also includes entire sections of the income statement, such as revenue, expenses, operating income, EBITDA, net income. The primary difference between vertical analysis and horizontal analysis is that vertical analysis is focused on the relationships between the numbers in a single reporting period, or one moment in time. In the context of an income statement, vertical analysis provides insights into the distribution of revenues and expenses. By expressing each line item as a percentage of total revenue, analysts can identify the relative significance of various components.

How Can Vertical and Horizontal Analysis Help Individuals Make Better Financial Decisions?

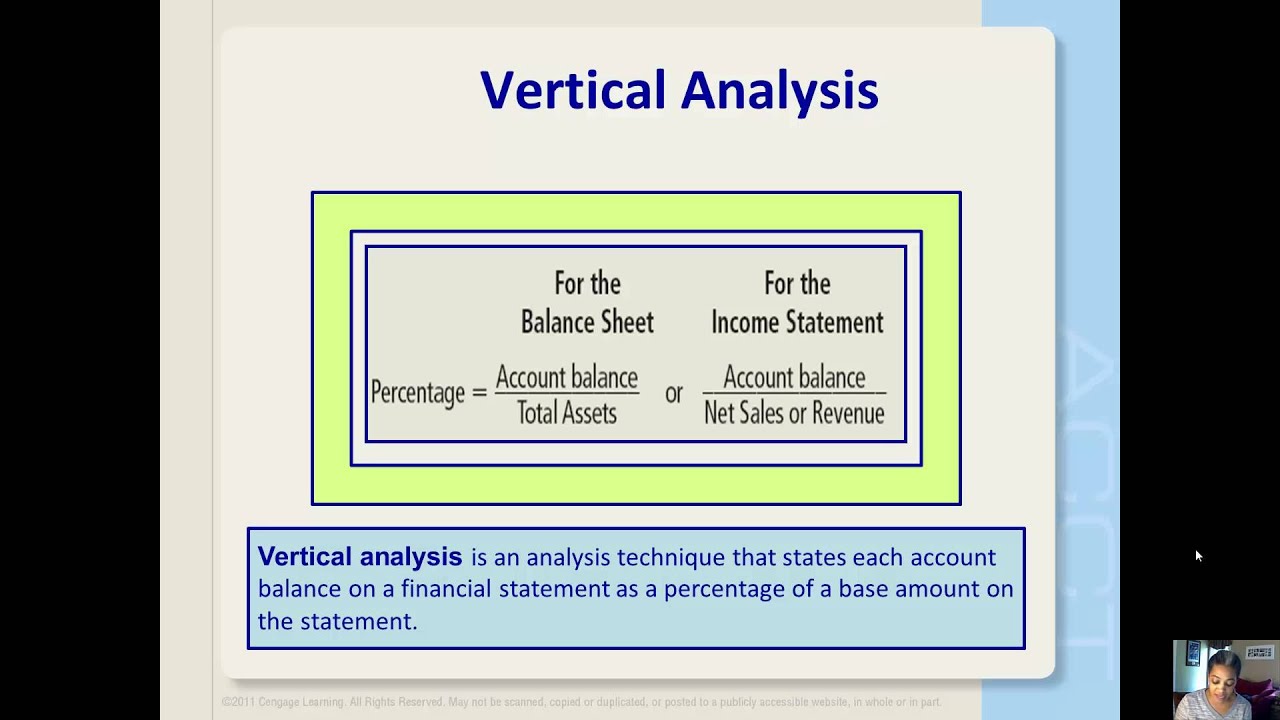

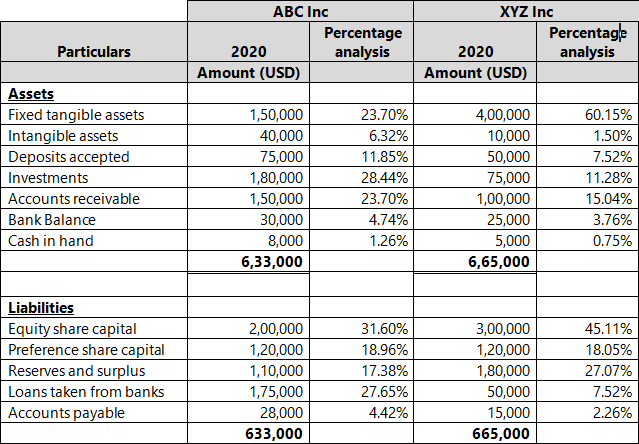

This aids in assessing the cost structure, profitability ratios, and the overall composition of the income statement. Vertical analysis involves expressing each line item as a percentage of the base item. In the income statement, for instance, every revenue and expense item is presented as a percentage of total revenue. On the balance sheet, each asset, liability, and equity item is represented as a percentage of total assets. This normalization of values facilitates a meaningful comparison of the relative contribution of each component to the whole. Financial analysis is crucial for business decision-making, and vertical and horizontal analysis are essential tools for understanding a company’s financial performance.

What is Horizontal Analysis?

- The primary objective of horizontal analysis is to identify trends, patterns, and fluctuations in financial performance.

- Comparative financial statements reflect the profitability and financial status of the concern for various accounting years in a comparative manner.

- E-commerce companies can benefit greatly from analyzing financial statements over time using horizontal analysis and benchmarking against industry averages with vertical analysis.

- By comparing numbers across consecutive accounting periods, horizontal analysis quantifies increases or decreases as a percentage.

Financial statements are the window to a business entity’s financial performance and health. Various stakeholders such as shareholders, investors, creditors, banks etc. assess and analyze the financial statements. This analysis helps them gauge various aspects of the entity’s financial health which then forms the basis for their decision making.

Selecting a Base Year for Comparison

In this analysis, the very first year is considered as the base year and the entities on the statement for the subsequent period are compared with those of the entities on the statement of the base period. Comparing changes to industry benchmarks provides further context for assessing performance. Overall, horizontal analysis delivers insights into the company’s historical performance. Horizontal scaling adds more servers to handle increased demand, while vertical scaling upgrades the power of a single server. Scaling vertically is cheaper in the short run, especially for startups that don’t have many resources because it uses already-set infrastructure. But horizontal scaling does tend to result in much more predictable costs over time since firms can add nodes incrementally depending on demand and thus are more budget-friendly in the long run.

Key Takeaways

Knowing their infrastructure is stable, companies will look to deploy new technologies and advanced applications and enhance services without any risk due to performance. This enables the ability to try new things, creating greater growth in agility and an advantage over other competitive markets. The debt ratios calculate how much debt a company has about its assets or equity. Examples include inventory turnover ratios and accounts receivable turnover ratios.

Comparison Period to Base Period Percentage Change Example

Vertical analysis is a method of financial statement analysis where each line item on a financial statement is shown as a percentage of another key item. This allows for easy analysis between companies or between periods for a company. To accurately compare financial statement data, the underlying accounting standards used to produce the financials must be considered. Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) have enough differences that analyses should not mix companies using different standards. Comparing GAAP-based financials to other GAAP-based companies and IFRS to IFRS provides alignment needed for an apples-to-apples comparison. As an analyst, understanding the impacts of accounting standards is vital for drawing accurate conclusions from financial statement analyses.

While horizontal analysis focuses on changes over time, vertical analysis emphasizes the relative importance of different line items within a single period. Both methods provide valuable insights into a company’s financial performance and can be used together to gain a comprehensive understanding of its financial health. Horizontal analysis and vertical analysis are two valuable techniques used in financial statement analysis. Both methods provide unique insights into a company’s financial performance and can be used for benchmarking, identifying anomalies, and making informed decisions.

Horizontal scaling would, therefore, be ideal for businesses expecting sudden spurts in growth or seasonal spikes in demand, whereby seamless growth without an overhaul of the infrastructure would be possible. Vertical scaling may be practical for businesses experiencing steady growth, where an upgrade of the servers at hand can meet the demands of growth without any additional difference between horizontal and vertical analysis infrastructure. Horizontal scaling is a strategy for scaling servers by adding more nodes or servers to a network to distribute and handle increasing workloads. Instead of upgrading the hardware of a single server, horizontal scaling multiplies instances of servers. This way, each of them shares the load, thereby decreasing the burden on individual machines.